True/False

Indicate whether the

statement is true or false.

|

|

|

1.

|

The Phillips curve illustrates the positive relationship between inflation and

unemployment.

|

|

|

2.

|

If inflation is 4 per cent and unemployment is 6 per cent, the misery index is 2

per cent.

|

|

|

3.

|

In the short run, an increase in aggregate demand increases prices and output,

and decreases unemployment.

|

|

|

4.

|

When unemployment is below the natural rate the labour market is unusually

tight, putting pressure on wages and prices to rise.

|

|

|

5.

|

An increase in price expectations shifts the Phillips curve upward and makes the

inflation unemployment trade-off less favourable.

|

|

|

6.

|

An increase in the money supply increases inflation and permanently decreases

unemployment.

|

|

|

7.

|

In the long run, the unemployment rate is independent of inflation and the

Phillips curve is vertical at the natural rate of unemployment.

|

|

|

8.

|

When actual inflation exceeds expected inflation, unemployment exceeds the

natural rate.

|

|

|

9.

|

The natural rate hypothesis suggests that, in the long run, unemployment returns

to its natural rate, regardless of inflation.

|

|

|

10.

|

An adverse supply shock, such as an increase in the price of imported oil,

shifts the Phillips curve upward and makes the inflation unemployment trade-off less

favourable.

|

|

|

11.

|

A decrease in unemployment benefits reduces the natural rate of unemployment and

shifts the long-run Phillips curve to the right.

|

|

|

12.

|

An increase in aggregate demand temporarily reduces unemployment, but after

people raise their expectations of inflation, unemployment returns to the natural rate.

|

|

|

13.

|

A sudden monetary contraction moves the economy up a short-run Phillips curve,

reducing unemployment and increasing inflation.

|

|

|

14.

|

If people have rational expectations, an announced monetary contraction by the

central bank that is credible could reduce inflation with little or no increase in

unemployment.

|

|

|

15.

|

If the sacrifice ratio is four, a reduction of inflation from 9 per cent to 5

per cent requires a reduction in output of 8 per cent.

|

Multiple Choice

Identify the

choice that best completes the statement or answers the question.

|

|

|

16.

|

The misery index, which some commentators suggest measures the health of the

economy, is the sum of the

a. | growth rate of output and the inflation rate. | b. | natural rate of

unemployment and the actual rate of unemployment. | c. | inflation rate and the central bank’s

refinancing rate. | d. | unemployment rate and the inflation

rate. |

|

|

|

17.

|

The original Phillips curve illustrates the

a. | trade-off between inflation and unemployment. | b. | trade-off between

output and unemployment. | c. | positive relationship between output and

unemployment. | d. | positive relationship between inflation and

unemployment. |

|

|

|

18.

|

The Phillips curve is an extension of the model of aggregate supply and

aggregate demand because, in the short run, an increase in aggregate demand increases prices

and

a. | decreases growth. | c. | increases unemployment. | b. | decreases

unemployment. | d. | decreases

inflation. |

|

|

|

19.

|

Along a short-run Phillips curve, a higher rate of

a. | growth in output is associated with a higher unemployment rate. | b. | growth in output is

associated with a lower unemployment rate. | c. | inflation is associated with a higher

unemployment rate. | d. | inflation is associated with a lower

unemployment rate. |

|

|

|

20.

|

If, in the long run, people adjust their price expectations so that all prices

and incomes move proportionately to an increase in the price level, then the long-run Phillips

curve

a. | has a slope that is determined by how fast people adjust their price

expectations. | b. | is negatively sloped. | c. | is vertical. | d. | is positively

sloped. |

|

|

|

21.

|

According to the Phillips curve, in the short run, if policy makers choose an

expansionary policy to lower the rate of unemployment,

a. | the economy will experience an increase in inflation. | b. | the economy will

experience a decrease in inflation. | c. | inflation will be unaffected if price

expectations are unchanging. | d. | none of these

answers |

|

|

|

22.

|

An increase in expected inflation

a. | shifts the short-run Phillips curve downward and the unemployment inflation trade-off

is less favourable. | b. | shifts the short-run Phillips curve upward and

the unemployment inflation trade-off is more favourable. | c. | shifts the short-run

Phillips curve downward and the unemployment inflation trade-off is more

favourable. | d. | shifts the short-run Phillips curve upward and the unemployment inflation trade-off

is less favourable. |

|

|

|

23.

|

Which of the following would shift the long-run Phillips curve to the

right?

a. | An increase in the minimum wage | c. | An increase in the price of foreign

oil | b. | An increase in expected inflation | d. | An increase in aggregate

demand |

|

|

|

24.

|

When actual inflation exceeds expected inflation,

a. | unemployment is equal to the natural rate of unemployment. | b. | people will reduce

their expectations of inflation in the future. | c. | unemployment is greater than the natural rate

of unemployment. | d. | unemployment is less than the natural rate of

unemployment. |

|

|

|

25.

|

A decrease the price of foreign oil

a. | shifts the short-run Phillips curve downward, and makes the unemployment inflation

trade-off less favourable. | b. | shifts the short-run Phillips curve upward, and

makes the unemployment inflation trade-off less favourable. | c. | shifts the short-run

Phillips curve upward, and makes the unemployment inflation trade-off more

favourable. | d. | shifts the short-run Phillips curve downward, and makes the unemployment inflation

trade-off more favourable. |

|

|

|

26.

|

The natural rate hypothesis argues that

a. | in the long run, the unemployment rate returns to the natural rate, regardless of

inflation. | b. | unemployment is always below the natural rate. | c. | unemployment is

always above the natural rate. | d. | unemployment is always equal to the natural

rate. |

|

|

|

27.

|

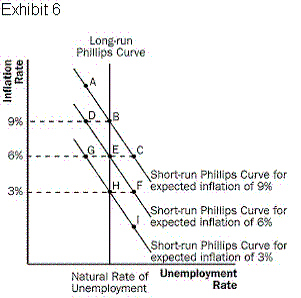

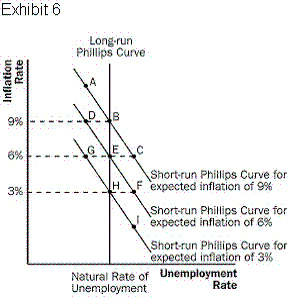

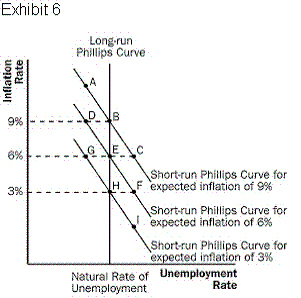

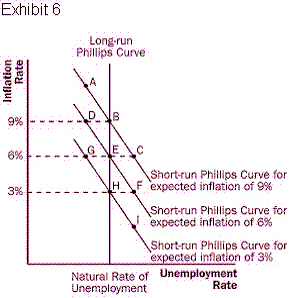

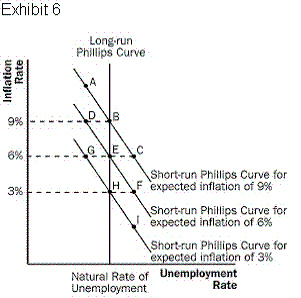

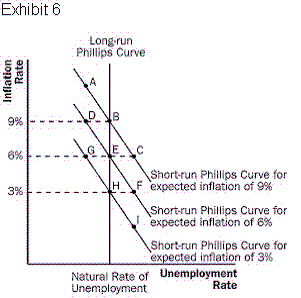

Refer to Exhibit 6. If people in the economy expect inflation to be 3 per cent

and inflation is 3 per cent, the economy is operating at point  a. | Point A | b. | Point B | c. | Point

E | d. | Point H | e. | Point I |

|

|

|

28.

|

Refer to Exhibit 6. If people in the economy expect inflation to be 6 per cent

but inflation turns out to be 3 per cent, the economy is operating at point  a. | Point A | b. | Point C | c. | Point

D | d. | Point F | e. | Point H |

|

|

|

29.

|

Refer to Exhibit 6. Suppose the economy is in long-run equilibrium at point E. A

sudden increase in government spending should move the economy in the direction of point  a. | Point A | b. | Point B | c. | Point

D | d. | Point E | e. | Point G |

|

|

|

30.

|

Refer to Exhibit 6. Suppose the economy is operating at point D. As people

revise their price expectations,  a. | the short-run Phillips curve will shift in the direction of the short-run Phillips

curve associated with an expectation of 3 per cent inflation. | b. | the short-run

Phillips curve will shift in the direction of the short-run Phillips curve associated with an

expectation of 9 per cent inflation. | c. | the short-run Phillips curve will shift in the

direction of the short-run Phillips curve associated with an expectation of 6 per cent

inflation. | d. | the long-run Phillips curve will shift to the left. |

|

|

|

31.

|

Refer to Exhibit 6. Suppose the economy is operating in long-run equilibrium at

point E. An unexpected monetary contraction will move the economy in the direction of

point  a. | Point A | b. | Point C | c. | Point

E | d. | Point F | e. | Point H |

|

|

|

32.

|

Refer to Exhibit 6. Suppose the economy is operating in long-run equilibrium at

point E. In the long run, a monetary contraction will move the economy in the direction of

point  a. | Point A | b. | Point B | c. | Point

F | d. | Point H | e. | Point I |

|

|

|

33.

|

If people have rational expectations, a monetary policy contraction that is

announced and is credible could

a. | reduce inflation with little or no increase in unemployment. | b. | increase inflation

but it would decrease unemployment by an unusually large amount. | c. | increase inflation

with little or no decrease in unemployment. | d. | reduce inflation but it would increase

unemployment by an unusually large amount. |

|

|

|

34.

|

If the sacrifice ratio is five, a reduction in inflation from 7 per cent to 3

per cent would require

a. | a reduction in output of 5 per cent. | c. | a reduction in output of 20 per

cent. | b. | a reduction in output of 15 per cent. | d. | a reduction in output of 35 per

cent. |

|

|

|

35.

|

If a country’s policy makers were to continuously use expansionary

monetary policy in an attempt to hold unemployment below the natural rate, the long-run result would

be

a. | an increase in the level of output. | c. | an increase in the rate of

inflation. | b. | a decrease in the unemployment rate. | d. | all of these

answers. |

|